How do you balance the immediate needs of your kids with their future requirements? Tough questions, right? As a dad, I always wonder how to best allocate our hard-working money, so our kids can have lots of opportunities and fun when young while having some support as they grow older.

Tertiary education is not often on the radar of parents when their kids are very young. In fact, many parents have no financial plan or savings to help their kids as they go to University or College. While they will do their best to help once they get there, many ’kids’ will still be required to take a sizeable student loans to complete their studies.

Australian graduates are sitting on $60bn of student loans with the average grad holding a whopping $30,000 in debt. That’s not a small number, noting that those grads are required to start repaying it once their salaries hit $52,000. And chances are that the repayment threshold will be much lower in 5 to 10 years from now as our government shifts student funding towards the requirements of our aging population.

Some would argue that having student debt is not so bad because it helps the young adults to be disciplined. Really? I prefer to think that ‘discipline’ is a value that kids learn from parents, family and friends, not from having to repay debt. Others may argue that having debt motivates the graduates to work harder. Again… really? If my son needs debt to be motivated, I must have done something wrong as a dad.

When you are 18, 19 or 20, you are full of dreams, energy, and excitement. You should be able to take on risks and pursue your dreams rather than having to worry about having debt on your shoulders. The debt will affect your decisions and limit what paths you may take in life.

Unfortunately, raising a child is very expensive and education is a big component of it. Of course, we as parents want to be able to pay for all if we can. However, not many of us manage to do so. And one of the main reasons is simply the lack of planning.

So what can we parents do to at least reduce the potential student debt burden on our kid’s shoulders?

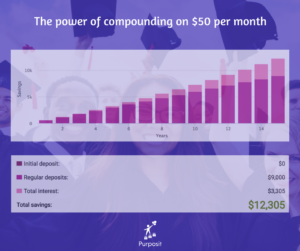

Start saving early!! Have a bank account set up for your child from a young age and put a little bit of money every now and then. An example – if you put $50 a month on your child’s account for 15 years, he or she will have accumulated $12,300.

That’s based on an interest rate of 4%pa (in reality, and you will likely see periods of higher rates during a 15 year cycle.). Even if we assume that the average student loan grows with inflation (as uni fees rise) during those 15 years (3%pa to $47k), your monthly savings plan would already cover 25% of the debt principal. Pretty good right?

That’s based on an interest rate of 4%pa (in reality, and you will likely see periods of higher rates during a 15 year cycle.). Even if we assume that the average student loan grows with inflation (as uni fees rise) during those 15 years (3%pa to $47k), your monthly savings plan would already cover 25% of the debt principal. Pretty good right?

Another tip: be smarter about your loved one’s capital. What do I mean by that? Simple. When your kid’s birthday is coming up, always give your friends and family the option of contributing to a school or uni fund.

Remember that your friends want to help and they want to give gifts or presents that are useful. So make sure they know what those gifts are on a special occasion for your children. Nobody wants to give your child another digger or doll just for the sake of it. But when they do not know what to give – or are time constrained – they default to ‘classic’ toys.

A few years ago, The UK Telegraph published an article showing that the average 10-year-old had 238 toys at home but only played regularly with 12. So only 5% of the toys your kid has at home are being used.

![]()

I’d like to think that at least some of the money spent on the other 95% of unused toys could have been better allocated towards education, travelling, activities or any other gifts that could have a more positive impact on that child. But the only way to make it happen is by telling those who give your kids some of those toys – relatives and friends – what your children really needs.

I’d like to think that at least some of the money spent on the other 95% of unused toys could have been better allocated towards education, travelling, activities or any other gifts that could have a more positive impact on that child. But the only way to make it happen is by telling those who give your kids some of those toys – relatives and friends – what your children really needs.

So start saving early for those big milestones. With some help from interest rates (compounding!!) and contributions from friends & family, your child’s student debt burden could be much smaller than the average. And depending on the generosity of your loved ones, it could disappear completely.

What about you? Do you have any personal experiences or stories you would like to share to help other parents or families dealing with the financial challenges of paying for education?

Like our Blog? then check out our App!

Purposit is a free, easy and secure platform where parents fund meaningful gifts for their kids with the help of friends and family.

All devices

Iphones only

Also published on Medium.